In these uncertain times, a voice of reassurance and knowledge makes all the difference. Many people today are torn about the fact of whether they should start making big investments amid a pandemic. The global crisis has brought financial pressure to secure our health, family, property, and livelihood. At the same time, staying at home encouraged us to appreciate the value of having a safe shelter.

This renewed focus on home living led some homeowners to consider investing in a new home in safer and secure communities. It is no wonder why real estate continues to be a thriving industry despite the pandemic. Along with the desire to buy a new home, homebuyers are turning to mortgage calculators to estimate their payment and find out how much they can afford for a new home.

Buying a new home during a global crisis has its own ups and downs. There are so many factors that affect the home buying process. While interest rates are now at a record low, applying for a mortgage has become more difficult because of the stricter lending guidelines brought by the pandemic.

If you’re currently debating whether to buy a new home or wait until the pandemic ends, this article will shed light on the different factors that affect a home buying decision.

Do you have sufficient savings?

Having enough savings determines the success of a mortgage application. The lender will want to confirm if your savings can finance the upfront costs of the property. So if you’ve been eyeing a particular property, you better check your savings first if they can cover the closing costs and down payment.

The down payment depends on the mortgage you applied for, which is anywhere between 3.5% to 20% of the purchase price, while the closing costs make an extra 2% to 5%. The amount of your savings will inform the lender if you’re capable to pay for future emergency expenses and mortgage payments.

Often, lenders prefer their clients have more than enough money to cover not only the down payment but also a payment reserve for three to six months. This will let them know if you can consistently pay for your due payments.

Do you have a stable income?

It’s important to be financially secure when buying a property. Others often make the mistake of focusing on the house price and the interest rate of the mortgage loan. While these costs are very important, these things aren’t the only expenditures involved in homeownership. These expenses include the down payment, title-based fees, appraisal fees, state recording fees, prepaid property taxes, homeowner’s insurance, and interest, among others.

Taking the time to plan and budget before a home purchase is your safety net from all the unexpected expenses that may arise. A good sign you’re prepared for homeownership is having a steady income in the last few years. Since the COVID-19 pandemic has brought about financial pressures to all of us, having a stable job and income will give you and the lender peace of mind that you can cover all the expenses of buying a new home.

Lenders are going to investigate if you’re consistently employed to ensure your salary can cover the mortgage costs. Most lenders will ask the applicant about the status of their employment and income in the last two years. Some are even asking for pay stubs before a closing. Meanwhile, lenders require self-employed applicants to present their tax returns for the last two years.

How big is your debt?

The debt-to-income ratio (DTI) is another factor that affects the home buying process. The lender will want to know if you can afford to pay the monthly mortgage, given your monthly income and current debts.

The DTI includes bills such as credit card debt, car payments, and student loans. Home expenses such as gas, essential goods, and other utilities are excluded. Although the level of DTI varies depending on the mortgage type and lender, it is better to have a DTI lower than 43%. Otherwise, you might as well prioritize settling those debts before considering to buy a new home.

To compute the DTI, add all your monthly debts and divide the result by the gross monthly income before taxes. Multiply the number by 100 to know the percentage.

In this time of global crisis, it’s important to pause and evaluate your financial situation before committing yourself to big investments. In reality, it’s hard to secure a mortgage during a pandemic given the current economic circumstances. But if you’re financially secure, it might be better to avail of the low-interest rates and get an amazing deal for the new home you’ve always wanted.

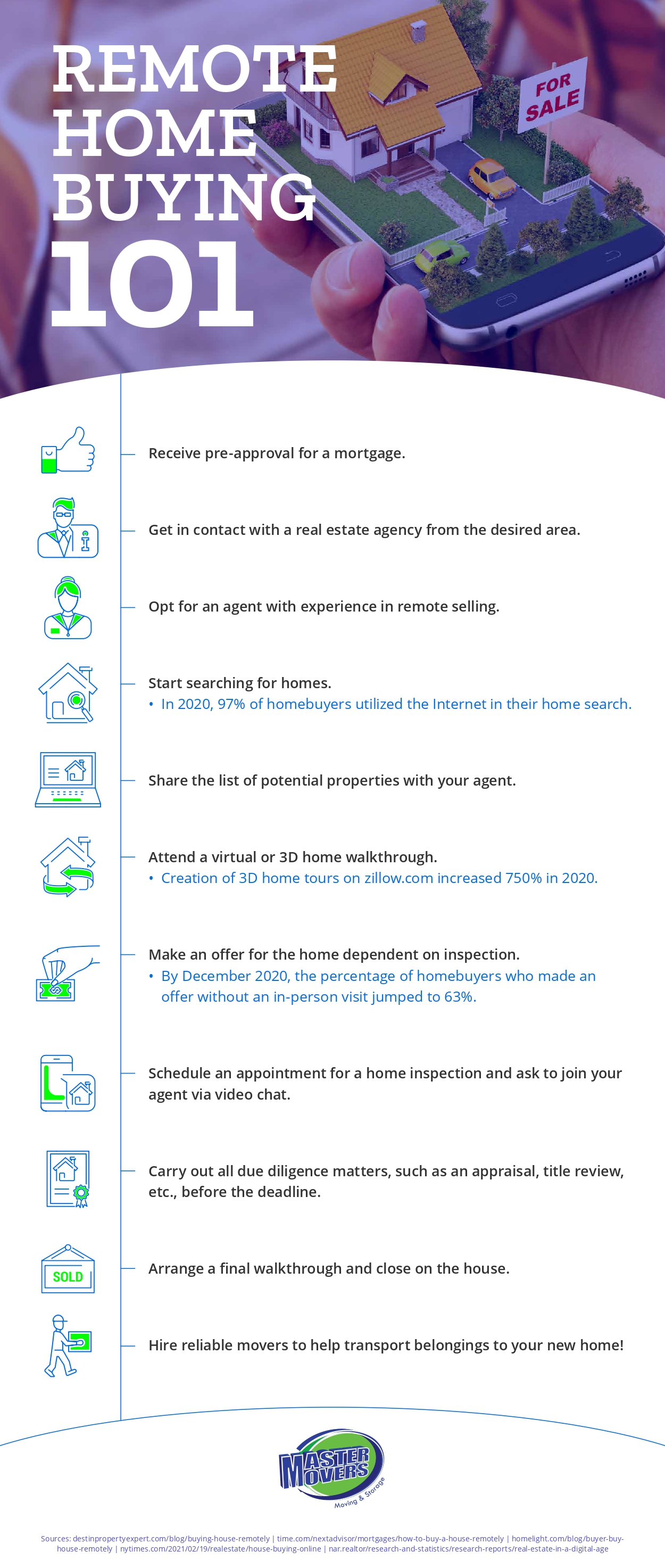

Infographic provided by Master Movers, a Venice, FL moving company